|

|

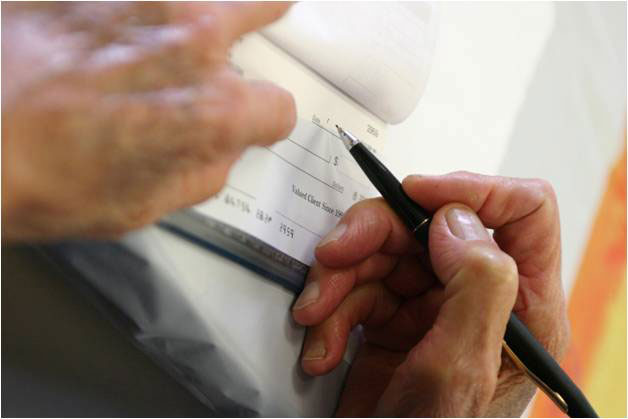

Stopping Elder Financial Abuse: Promising Practices and How to Bring Them to Your Community

An online webinar supported by the Archstone Foundation

Read on for free resources you can use

Presenters: Julie Schoen, Esq. and Shawna Reeves, MSW

Webinar hosted by Center of Excellence on Elder Abuse & Neglect at UC Irvine

This webinar took place on December 12, 2011. Access the articles, factsheets, recording, slides, and sample documents below.

California professionals in aging services and elder abuse prevention: use the tools provided below for Stopping Elder Financial Abuse!

We're very grateful to nationally recognized advocates Shawna Reeves and Julie Schoen for sharing their extensive knowledge and experience with us.

Topics include:

- Cheap and Easy Ways to "Guerilla Market" Elder Financial Protection Concepts to Senior Citizens and Professionals

- Supporting Senior Centers in Financial Elder Abuse Prevention

- Benefits of Financial Abuse Specialist Teams and Tips on Using Them

- Screening for Reverse Mortgage Abuse

Download the slides (PDF)

Hear/View the webinar recording (AdobeConnect)

About the Speakers

Shawna Reeves, MSW is director of financial education and advocacy at Council on Aging Silicon Valley in San Jose, CA. For the past six years, Shawna has helped seniors fight back against financial predators. She has presented on predatory lending and investment scams throughout the country and engaged in legislative advocacy at the local, state and national levels. In July 2010, she lead-authored an article on financial abuse prevention strategies that appeared in the Journal of Elder Abuse and Neglect. In December 2010, she co-authored a report titled "Examining Faulty Foundations in Today's Reverse Mortgages" with Consumers Union and California Advocates for Nursing Home Reform. Shawna received her bachelor's degree in political science from Santa Clara University and her master's degree in social work from Smith College. Her current interests are enhancing consumer protections for reverse mortgages, blocking financial predators from senior centers, and using social media to raise awareness of elder abuse. Shawna also teaches social welfare policy analysis at San Jose State University's Master of SocialWork Program.

Julie R. Schoen, Esquire, Corporate Legal Counsel, Director Department of Elder Abuse Prevention Ms. Schoen serves as Legal Counsel for the Council on Aging and Advisory Legal Counsel for the Health Insurance Counseling and Advocacy Program(HICAP). She is also directing the Financial Abuse Specialist Team. She is a graduate of the University of Wisconsin at Madison School of Education and received her Juris Doctorate degree from Western State University College of Law. Ms. Schoen's service to the community includes:

- Community Educator on the rights of Medicare Beneficiaries

- Testified before Congress on the rights of Medicare Beneficiaries in Managed Care

- Past Advisory Board Member Orange Caregiver Resource Center

- Past President Orange County Senior Roundtable

- Board of Directors Westminster Senior Center Foundation

Additional Resources Provided by the Speakers

“Guerilla Market” Your Elder Financial Protection Concepts

- Reeves, S., & Wysong, J. (2010). Strategies to address financial abuse, Journal of Elder Abuse & Neglect, 22(3), 328 – 334. http://www.tandfonline.com/doi/abs/10.1080/08946566.2010.490182

Financial Abuse Specialist Team (FAST) Description http://www.coaoc.org/html/services_fast_description.htm

Senior Center Protection Plan

- Two-page overview (What, Why, Who, etc.) http://www.centeronelderabuse.org/docs/ElderAbuseinHomeLendingProtection.doc

- Shawna Reeves' letter including case examples, need for the plan from a social worker's perspective, and an endorsement of the Senior Center Protection Plan http://www.centeronelderabuse.org/docs/Senior_Center_Package_Letter.doc

Reverse Mortgage 411

Garcia, N.P., Cole, P., & Reeves, S. (2010). Faulty foundations in today’s reverse mortgages. Consumers Union

See also: http://www.centeronelderabuse.org/docs/Reverse_Mortgage_Letter.doc

Download the webinar slides (PDF)

Hear/View the webinar recording (AdobeConnect)